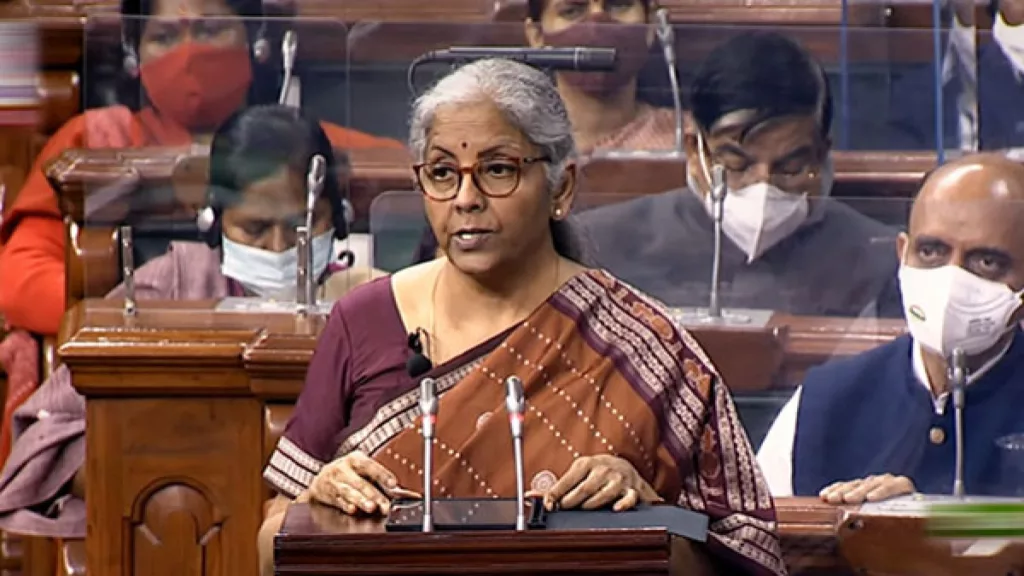

Union Finance Minister Nirmala Sitharaman is set to introduce the revised Income Tax Bill, 2025 in the Lok Sabha on August 11, replacing the earlier draft tabled in February. The move follows extensive feedback from a Select Committee and aims to modernize India’s tax framework by replacing the 63-year-old Income Tax Act of 1961.

Why Was the Original Bill Withdrawn?

The original draft, introduced on February 13, 2025, was formally withdrawn last week. Parliamentary Affairs Minister Kiren Rijiju clarified that incorporating over 285 suggested changes through amendments would have been procedurally inefficient. Instead, the government opted to present a fresh, consolidated version.

Key Features of the Revised Income Tax Bill

The updated bill includes several significant reforms:

- Faceless Assessment System: A digital-first approach to reduce corruption and simplify compliance.

- Simplified Legal Language: Replaces complex terminology with clearer, accessible phrasing.

- TDS Refunds Post-Deadline: Taxpayers can now claim refunds even after missing the ITR deadline.

- Anonymous Donations Restricted: Only religious trusts can receive anonymous donations; social service trusts are excluded.

- Mandatory Notices Before Action: Tax authorities must issue notices and consider responses before initiating proceedings.

- Inter-Corporate Dividend Relief: Restores Section 80M deductions for companies under Section 115BAA.

- NIL TDS Certificates: Taxpayers can apply for certificates to avoid unnecessary tax deductions.

Significance of the Reform

This bill is being hailed as one of the most ambitious tax reforms in recent decades. It aims to:

- Streamline litigation

- Enhance taxpayer rights

- Improve transparency and efficiency in tax administration

The Select Committee, chaired by BJP MP Baijayant Panda, submitted a 4,500-page report that formed the backbone of the new draft.

What’s Next?

The bill will be debated in Parliament during the ongoing Monsoon Session. If passed, it will mark a historic shift in India’s direct tax regime, aligning it with global best practices and digital governance.