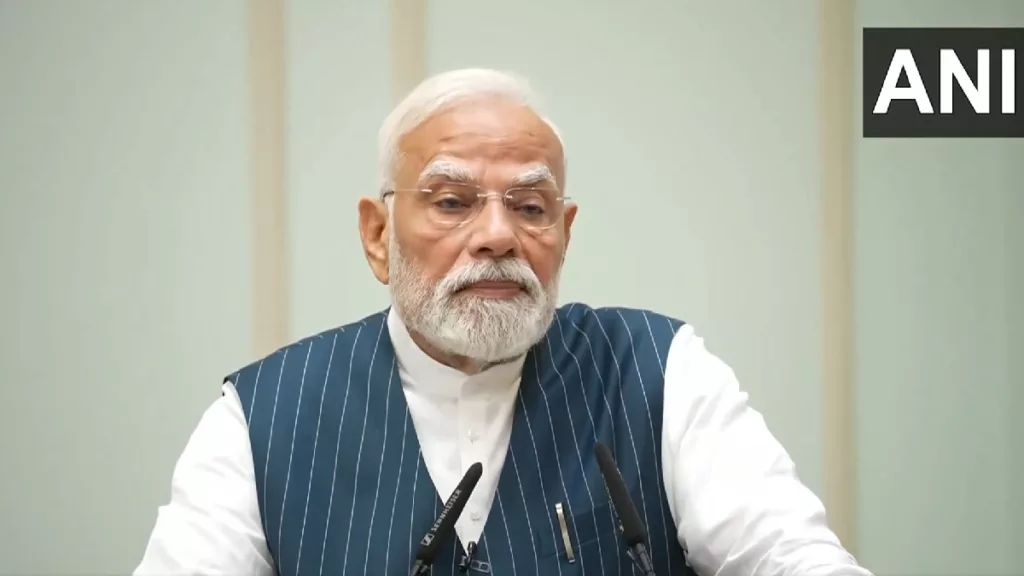

In a spirited address at the National Teachers’ Awards ceremony, Prime Minister Narendra Modi unveiled sweeping reforms to India’s Goods and Services Tax (GST), calling them a “double blast of happiness” ahead of Navratri and Diwali. The overhaul, which simplifies the tax structure to two primary slabs—5% and 18%—alongside a steep 40% rate for luxury and sin goods, is set to take effect on September 22.

The Prime Minister’s remarks were not just celebratory but sharply political. Criticizing the previous Congress-led government, Modi quipped, “They used to levy a 21% tax even on toffees for children. If Modi had done this, they would have pulled my hair out.” The comment underscored his administration’s positioning of the reforms as pro-poor and pro-middle class.

The Five Gems of GST Reform

Modi framed the reforms as a transformative leap for the Indian economy, listing five key benefits:

| Gem | Impact |

| Simpler Tax System | Reduces classification disputes and eases compliance |

| Improved Quality of Life | Cuts taxes on kitchen staples, medicines, and health products |

| Boost to Consumption & Growth | Lower prices expected to spur domestic demand |

| Enhanced Ease of Doing Business | Encourages investment and job creation through streamlined processes |

| Strengthened Cooperative Federalism | Reinforces Centre-State collaboration via the GST Council |

These changes follow the 56th GST Council meeting, which approved the rationalization amid consensus from state representatives and the Union Finance Ministry.

Civic and Social Dimensions

Beyond economic metrics, Modi emphasized the reforms’ social impact. By exempting life-saving drugs and personal insurance premiums from GST, the government aims to make healthcare more affordable. The Prime Minister also highlighted a new law banning online betting and gambling, framing it as a safeguard for India’s youth.

“Gaming is not bad, but gambling is,” he said, urging students to think of ways to fulfill national needs. The move aligns with broader efforts to regulate digital spaces and protect vulnerable populations.

Industry Response and Political Undercurrents

Industry leaders have welcomed the reforms, citing potential boosts to GDP and consumer confidence. However, the timing—just ahead of major festivals and state elections—has sparked debate over political motivations. Modi’s pointed critique of past tax regimes suggests a strategic narrative aimed at contrasting governance styles.

While the Congress party has yet to issue a formal response, analysts expect the reforms to become a flashpoint in upcoming electoral campaigns.

Looking Ahead

As the new GST regime rolls out on the first day of Navratri, its real-world impact will be closely watched. For now, Modi’s “Diwali Dhamaka” promises not just festive cheer but a recalibration of India’s fiscal architecture—one that blends economic pragmatism with populist appeal.